7 Ways to Celebrate Financial Planning Month

7 Ways to Celebrate Financial Planning Month

October is recognized as Financial Planning Month, an annual event dedicated to planning for an independent financial future. Whether you’re a novice or knowledgeable in finance, assessing your finances and goals is always beneficial.

This yearly event provides the perfect opportunity to reflect on spending habits, saving, investment strategies, and overall financial health. It allows us to rethink our financial steps and make better monetary decisions. Here are some ways you can actively participate.

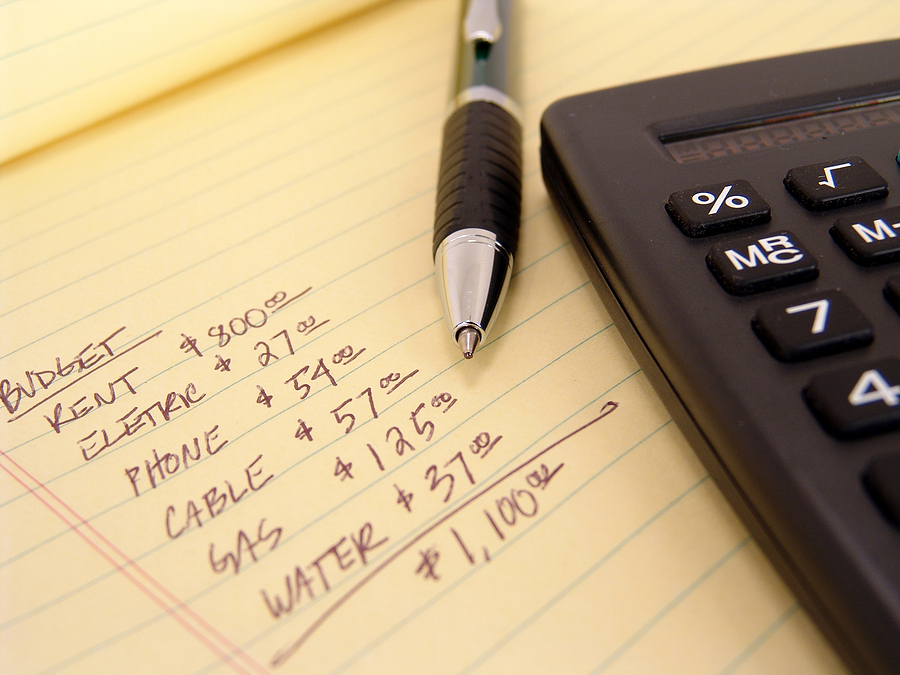

1. Conduct a financial audit

The first step to financial independence is understanding your financial situation. Take note of your income, expenses, debts, savings, and investment strategies. Look where your money is going and identify areas where you can cut back. Understanding your spending habits helps you establish a realistic budget that includes savings for short and long-term goals.

2. Increase your financial Literacy

Expanding your understanding of financial concepts and terminology can be a fun and engaging way to participate in Financial Planning Month. Many online resources, such as webinars, podcasts, eBooks, and articles, provide valuable information on different aspects of financial planning. Use this month to educate yourself on budgeting, saving, investing, tax planning, estate planning, risk management, etc.

3. Review your retirement savings plan

Now is the time to review your retirement savings plan to make sure you’re on track toward your goals. A financial professional can help review your plan and determine what adjustments to make.

4. Set clear financial goals

Whether you want to buy a home, fund your child’s education, start a business, or retire comfortably, having clear financial goals can help you prioritize your savings and spending to meet them objectively.

5. Hire a financial professional

Working with a financial professional can be highly beneficial if you find dealing with financial matters intimidating or confusing. They can provide personalized recommendations and strategies based on your situation, goal, risk tolerance, and timeline.

6. Participate in financial conversation

Conversations about finance benefit individuals when they can help teach others the importance of managing their finances comprehensively. Talking openly about financial issues with friends and family can help break down taboos and increase everyone’s financial literacy.

7. Contribute to an emergency fund

Since life is unpredictable, an emergency fund provides a safety net if you lose your job, have unexpected medical expenses, or face an unforeseen financial emergency. Make sure to allocate a part of your monthly income to building this fund up over time so that you have money to pay three to six months of expenses.

Participating in Financial Planning Month doesn’t necessarily mean changing your financial behavior. Even small steps like those above can positively impact your financial confidence.

SWG3811069-0824B This information is provided as general information and is not intended to be specific financial guidance. Before you make any decisions regarding your personal financial situation, you should consult a financial or tax professional to discuss your individual circumstances and objectives.

Sinclair Financial Solutions approaches financial planning differently than most. Our emphasis is on Financial Fitness, no matter your age or stage in life. The Financial Fitness Game plan encompasses multiple areas within one’s life, such as life insurance, health insurance, retirement planning, and auto insurance. THis helps to build a complete financial plan. Contact us today to begin yours.